Blog

Why Your Forecasts Keep Falling Flat (and How a GOOD Fractional CFO + Solid Accounting Work Fix This)

Sep 29th, 2025

You know that budget you created at the beginning of the year—the one collecting dust in your inbox? Yeah, that one. For a lot of business owners, the “budget vs. actual” comparison turns into a once-a-year reality check instead of the living, breathing tool it should be.

You know that budget you created at the beginning of the year—the one collecting dust in your inbox? Yeah, that one. For a lot of business owners, the “budget vs. actual” comparison turns into a once-a-year reality check instead of the living, breathing tool it should be.

Why Forecasting Without Discipline Is Pointless

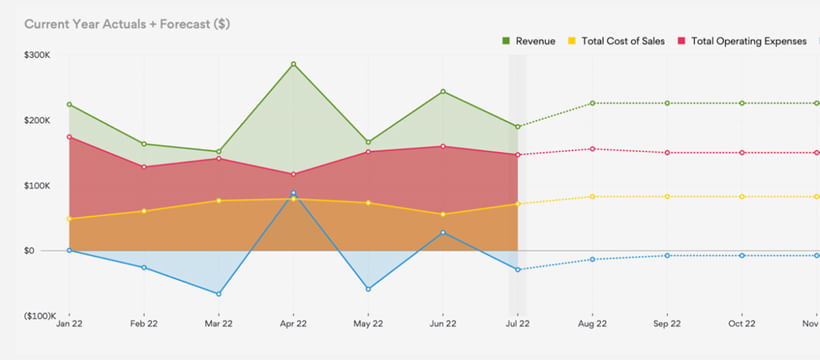

Think of a forecast like GPS. It only works if you actually update it when you take a wrong turn. If you’re just glancing at it once in a while, on a non-recurring or scheduled cadence, you’ll end up miles off track before you even notice, and this can have rippling (and devastating) impacts to your business when it comes to meeting end-of-the-year projections and goals.

This is where we see most businesses go wrong; They build a budget in January, file it away, and then wonder in October why their cash flow feels like a rollercoaster. Without regular re-forecasting, the numbers stop being a guide and start being a fantasy.

Enter the Fractional CFO

A fractional CFO isn’t just “extra brainpower.” They bring financial discipline to the table. Here’s how:

1. Monthly Forecast Reviews – Not once a year. Not “when you get around to it.” Monthly. Every. Single. Month. That’s how you stay honest about where you’re really headed.

2. Re-forecasting Against Actuals – Budgets are nice. But when reality changes (and it always does), your CFO updates the plan to match. It’s not about “missing the budget”—it’s about resetting the path so you stay in control.

3. Cash Flow Visibility – The lifeblood of your business. Forecasting it well means no more “oh crap, payroll is due” moments.

Garbage In = Garbage Out

Here’s the catch: even the sharpest CFO can’t spin gold out of bad data. If your books are a mess, your forecast will be a mess. Period.

That’s why forecasting only works when it’s built on clean, accurate accounting. Reconciled books, timely reporting, and a bookkeeping process that isn’t held together with duct tape and late-night Excel hacks.

When your accounting team and your CFO are aligned, you get forecasts that aren’t just guesses—they’re tools you can trust to run your business smarter.

Why This Matters for Small and Mid-Sized Businesses

Enterprise companies have in-house CFOs, finance departments, and armies of analysts. Smaller businesses don’t. But that doesn’t mean you should fly blind.

With a fractional CFO paired with solid accounting, you get the same financial discipline—without the six-figure payroll. And you get to run your business with the confidence of knowing what’s coming, not just what already happened.

Bottom Line

Forecasting isn’t about “predicting the future.” It’s about creating a disciplined process that keeps you aligned with reality and ready for what’s next.

A fractional CFO gives you that discipline in an external party and keeps you accountable as business leaders and owners to keeping yourself honest about what is real, and what is fantasty or “nice to hear”. Quality books give you the foundation for accurate forecasting and planning. Put them together, and you finally stop being surprised by your numbers—and start using them to make smarter, faster, more profitable decisions.

Let's Get

Started!

Reach out to schedule a free, introductory discovery call today.