Blog

Stop Playing Middleman With Your Money: Why One Outsourced Advisory Firm CAN Handle It All

Sep 29th, 2025

Let’s be real—running a business is already hard enough. You’re juggling sales, customers, employees, and about a thousand fires a day. The last thing you should be doing is babysitting your accountant, bookkeeper, and tax preparer because they’re all on different pages.

If you’ve got one person doing your books, another firm filing your taxes, and maybe even a separate “finance consultant” trying to make sense of it all—you’re basically paying three people to trip over each other while you clean up the mess. Not a great use of your time or money.

Here’s why pulling it all together under one roof isn’t just nice—it’s a game-changer.

1. No More “Who Dropped the Ball?”

When you spread your financial work across different groups and third-party providers, mistakes and duplicate work are almost inevitable. Finger pointing and “Oh, I thought they handled that” moments can become the norm, and efficiencies (the whole reason you outsourced in the first place) become less abundant and obvious.

When one firm owns your books, your taxes, and your finance strategy, there’s nowhere to hide. The same team that tracks your numbers is the one filing them. Which means fewer screw-ups, more accountability, and a lot less “surprise” come tax season.

2. Less Ping-Ponging, More Doing

Do you enjoy being the human Slack channel between your bookkeeper and your tax preparer? No? Then stop. With one team, you’re not stuck repeating yourself or resending the same spreadsheet five times. They already have what they need. You just get results.

3. Numbers That Actually Mean Something

Separate providers = everyone working in a silo. Which means you get compliance (barely) but zero insight.

When one firm sees the full picture—from your day-to-day books to your long-term strategy—they can tell you what’s working, what’s bleeding cash, and where you should double down. It’s not just “keeping you legal,” it’s giving you an edge.

Furthermore, if you work with a bookkeeper (for example) that isn’t staying up to date with reconciliations, transaction coding and/or is perhaps unequipped to be doing your books (from an Accountant standpoint) at a level your business requires, then come tax time, your tax preparer will inevitably be in a bind. If there are obvious inaccuracies, or things are hardly balanced, or your business books are being done on a cash basis but they SHOULD be handled on an accrual basis for substantial reasons, you could end up over or underpaying on your annual tax returns.

On the reverse side of things, if you go to a Fractional CFO that doesn’t understand accounting or tax work and they recommend a business restructuring or strategy that puts you in a bad financial position or means 10x the accounting work to keep up with that “strategy” for the desired financial output, you could end up paying a lot more to uphold that less-thought-out, non-holistic Financial Strategy.

Essentially, good books/accounting = solid tax work (i.e. you pay/receive the right amount – not too much or too little), and solid books + tax work = sound financial strategy & advisory.

4. Grows With You (Without the Growing Pains)

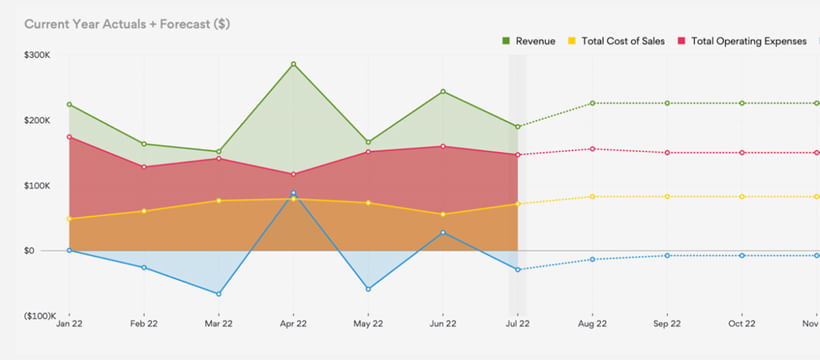

Right now, you might just need clean books and a tax return. But as you scale, you’re going to want budgets, forecasts, maybe even a fractional CFO. If you’ve got one firm in place that already gets you, adding services is easy. No awkward breakups with old providers. No onboarding nightmare. Just more support, same team.

5. It’s Cheaper Than Chaos

Paying three different firms to do overlapping work? That’s not “diversification” – that’s waste and redundancy. Consolidating can save serious money—and even if it doesn’t, the efficiency and accuracy alone are worth it that efficiency gains of you, the business owner, not having to play liaison between various parties that might not be on the same schedules, technology systems, time zones, etc.

Let's Get

Started!

Reach out to schedule a free, introductory discovery call today.